14 Nigerian Commercial banks fully met new capital requirement – CBN Governor

14 Nigerian Commercial banks fully met new capital requirement – CBN Governor

The Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, says 14 Nigerian banks have fully met the new capital requirement in the ongoing recapitalisation exercise.

Cardoso said this on Tuesday in Abuja, while presenting a communiqué from the 302nd meeting of Monetary Policy Committee (MPC) of the CBN.

The News Agency of Nigeria (NAN) reports that the CBN introduced a new minimum capital base requirement for banks, with tiers depending on licence type.

Before then, the last major bank recapitalisation exercise in Nigeria was in 2004, when the CBN raised the minimum capital requirement for all banks from two billion Naira to N25 billion.

This was a significant increase that led to a major consolidation in the banking sector, as the number of banks was reduced from 89 to 25 through a series of mergers and acquisitions.

In the current recapitalisation exercise, commercial banks with international authorisation now have a new capital requirement of N500 billion.

Commercial banks with national authorisation have N200 billion as capital requirement, and commercial banks with regional authorisation have N50 billion.

Merchant banks have a requirementof N50 billion, non-interest banks (national) N20 billion and non-interest banks (regional), N10 billion.

According to Cardoso, members of the MPC acknowledged the significant progress in the ongoing bank recapitalisation exercise, as 14 banks have fully met the new capital requirement.

“They, therefore, urged the CBN to continue the implementation of policies and initiatives that would ensure the successful completion of the ongoing recapitalisation exercise,” he said.

He said that the committee further noted the successful termination of forbearance measures and waivers on single obligors, which has helped to promote transparency, risk management, and long-term financial stability in the banking system.

“The MPC reassured the public that the impact of the removal of forbearance is transitory and does not pose any threat to the soundness and stability of the banking system, price, and other domestic developments.”

Cardoso had earlier announced the decision of the MPC to reduce the Monetary Policy Rate (MPR) by 50 basis points to 27 per cent from 27.50 per cent.

The committee also adjusted the standing facilities corridor around the MPR to +250/- 250 basis points and adjusted the Cash Reserve Ratio (CRR) for commercial banks to 45 per cent from 50 per cent.

It, however, retained the CRR for merchant banks at 16 per cent, while keeping the Liquidity Ratio unchanged at 30 per cent.

According to the CBN governor, the committee Introduced a 75 per cent CRR on non-TSA public sector deposits to enhanceliquidity management.

He said that the committee’s decision to lower the MPR was predicated on the sustained disinflation recorded in the past five months.

He said that the decision was also informed by projections of declining inflation for the rest of 2025, and the need to support economic recovery efforts.(NAN)

News

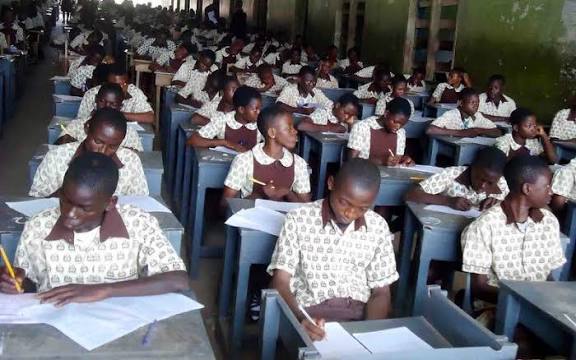

Govt. introduces solar installation, garment making, GSM repairs in jss curriculum

Govt. introduces solar installation, garment making, GSM repairs in jss curriculum

The Anambra Government has introduced 15 entrepreneurial subjects into the Junior Secondary School (JSS) curriculum to enhance students’ practical skills and foster an entrepreneurial mindset.

The News Agency of Nigeria (NAN) reports that the new subjects include solar installation, garment making, GSM repairs, agriculture and processing, plumbing, tiling, POP installation and event management.

Others are bakery, hairstyling, make-up, interior design, CCTV/intercom installation, digital literacy, information technology and robotics.

Prof. Nkechi Ikediugwu, Chairperson ,Post Primary Schools Service Commission (PPSSC), while speaking at the occasion in Awka on Friday, said the initiative was aimed at repositioning education to meet contemporary needs.

Ikediugwu noted that in a rapidly changing world, education should go beyond theory and examinations to equip students with practical skills, creativity, innovation and an entrepreneurial mindset.

“The goal of the programme is to prepare learners, not only to seek jobs but to create value, generate employment and contribute meaningfully to the economic development of the state,”she said.

Mr Cyril Nwuche of Nnamdi Azikiwe University, Awka, delivered a paper titled “Building Entrepreneurial Secondary Schools: Why Every School Needs an Entrepreneurship Club”.

Nwuche said the introduction of entrepreneurial subjects showed that the government was on the path to transforming the state’s economy.

“Traditional academic instruction alone is no longer sufficient to prepare children for the future.

“There is the need for schools to embrace practical and skill-based learning to enable students to thrive in a dynamic global environment, ” he said. (NAN)

News

Two men docked for allegedly defiling underaged girl

Two men docked for allegedly defiling underaged girl

The police in Lagos on Friday, charged two men before an Ikeja Chief Magistrates’ Court for allegedly defiling an 11- year-old girl.

The defendants are: Prince Tomnyie, 40, a businessman, who resides at Agege, and Micheal Adenuga, 24, a furniture maker, who resides at Atere Street in Lekki.

They are standing trial on charges of defilement, and had each pleaded not guilty to the charges.

The prosecutor, ASP Adegoke Ademigbuji told the court that they committed the offence sometimes in December 2024, and September 2025, at Langbasa Ajah and Igbara Lekki, Lagos .

The prosecutor alleged that the victim’s father, had taken his daughter for medical check and it was discovered that the minor had been defiled.

The prosecution alleged that the victim had told her father that his friend, Tomnyie, defiled her sometimes ago.

Ademigbuji alleged that the victim also mentioned the second defendant’s name who lives in their neigbourhood.

The offence contravenes the provisons of section 137 of the Criminal Law of Lagos, 2015.

The Chief Magistrate, Mr L. A Owolabi, granted the defendants bail in the sum of of N600,000 each, with two sureties each in like sum.

He adjourned the case until March 5, for mention. (NAN)

News

Report any officer asking for money for release of suspect as Police insist bail is free

Report any officer asking for money for release of suspect as Police insist bail is free

The Police Command in the Federal Capital Territory (FCT) has insisted that bail is free, and called on the public to report any officer asking for money to release a suspect on bail.

The Police Public Relations Officer in the FCT, SP Josephine Adeh, said this in an interview with the News Agency of Nigeria (NAN) on Friday in Abuja.

Adeh spoke in reaction to public outcry that some police officers were demanding money to release suspects on bail in the territory.

She said the report of the erring officers would serve as a deterrent to others, adding that it was fraudulent to demand for money to release a suspect on bail.

Adeh blamed the yielding to such fraudulent demand on ignorance on the part of the victims who refused to stand on their rights.

“A similar case was reported where an officer demanded money to release a suspect on bail and when the matter was reported, we requested for evidence from the victim.

“The evidence was provided because the money was transferred to the officer’s account and actions are being taken on the issue.

“So, I encourage the public to take advantage of the FCT Police Complaint Response Unit (CRU) lines on 08107314192 to report such misconduct with evidence,” she said.

Adeh urged the public to always insist on their rights and refuse any form of payment to release a suspect on bail.(NAN)

-

6 years ago

Our situation in Kano terrible – Gov Ganduje cries out

-

News11 months ago

News11 months agoFG pledges commitment to enhance Police officers Welfare, implement Tinubu’s 8-point agenda for NPF

-

News11 months ago

News11 months agoBREAKING; NSCDC gets approval to commence 2025 recruitment exercise

-

News9 months ago

News9 months agoAlleged cocaine deal: Court issues orders in suspended DCP Abba Kyari’s case

-

News12 months ago

News12 months agoDPO under investigation for allegedly taking teenage girl to his home while in police custody

-

News12 months ago

News12 months agoJUST IN; Commissioner of Police bows out of Service

-

News9 months ago

News9 months agoJUST IN; Police Inspector dies watching Arsenal match

-

News12 months ago

News12 months agoBREAKING; NLC declare nationwide protest