Several ways you can benefit from President Tinubu’s Tax Reforms — Federal Govt tells Nigerians

Several ways you can benefit from President Tinubu’s Tax Reforms — Federal Govt tells Nigerians

The chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele has listed ways Tax Reforms will benefit Nigerians.

Through a post on his X account on Monday, December 9, Oyedele highlighted ways households and individuals including the youth, small businesses, businesses and investments, high income earners and HNIs and subnational governments can benefit from the reforms.

According to Oyedele, there is something in the tax bills for everyone.

Here are ways you can benefit from tax reforms:

A. Households and individuals including the youth:

1. Complete exemption of low-income earners up to N1m p.a. (about N83k per month) from PAYE

2. Reduced PAYE tax for those earning a monthly salary of N1.7m or less

3. Zero (0%) VAT on food, healthcare, education, electricity generation and transmission

4. VAT exemption on transportation, renewable energy, CNG, baby products, sanitary towels, rent and fuel products

5. Tax break for wage award and transport subsidy to low-income earners

6. Tax incentives for employers to hire more people incrementally than in the previous 3 years

7. Exemption of stamp duties on rent below N10m

8. PAYE tax exemption for other rank and armed forces fighting insecurity

9. Friendly tax rules for remote workers and digital nomads

10. Clarity on taxation of digital assets to avoid double taxation and allow deduction for losses

B. Small Businesses:

1. Increase in tax exemption threshold for small businesses from annual turnover of N25m to N50m

2. Exemption from company income tax for small businesses (tax at 0%)

3. No withholding tax deduction on business income of small businesses

4. Exemption from the requirement to deduct and account for tax on payments to vendors

5. Simplified statement of accounts attested to by small business owner for tax returns in place of audited financial statements

6. Introduction of the Office of Tax Ombud to protect taxpayers against arbitrary tax assessments

7. Tax disputes affecting businesses to be resolved within 14 days by the Tax Ombud

8. Harmonisation of taxes and repeal of multiple levies

9. Outlaw cash payment and physical roadblocks imposing burden on businesses

10 Attractive tax regime to encourage formalisation of business and facilitate growth

C. Businesses and investments:

1. Reduction of corporate income tax rate from 30% to 25% and harmonisation of earmarked taxes at a reduced rate

2. Unilateral tax credit for income earned abroad to avoid double taxation and input VAT credit on assets and services to reduce cost of production.

3. Introduction of economic development incentive for priority sectors

4. Friendly tax regime for business restructuring and reorganisation to improve efficiency

6. Option to pay taxes and levies on foreign currency denominated transactions in Naira

7. Faster tax refunds within 90 days (30 days for VAT refunds) with the option of set-off against any tax liability of the taxpayer.

8. Request for advance ruling by taxpayer to be provided by tax authority within 21 days

9. Expense incurred by a start-up within 6 years pre commencement of business to be tax deductible

10. Restriction of interest deduction will only apply to related party loans in order to reduce cost of finance for businesses

D. High Income Earners and HNIs:

1. Tax exemption on personal effects not exceeding N5m, sale of dwelling house, and up to two private vehicles

2. VAT exemption on purchase of real estate

3. Clarity on taxation of benefit in kind and limit of taxable accommodation benefit to 20% of annual income

4. Exemption of tax on sale of shares up to N150m and gains not exceeding N10m

5. Progressive personal income tax rate up to 25% for HNIs

6. Tax exemption on compensation for loss of employment not exceeding N50m

7. Progressive VAT rate on items mostly consumed by high income earners to partly compensate for exemption on essential consumptions

8. Tax exemption for income earned on bonds issued by states in addition to federal government bonds

9. Reduction in corporate tax rate for businesses and tax break for hiring more people

10. Exemption of tax on bonus shares for investors in Nigerian companies

E. Subnational government:

1. Federal government to cede 5% of VAT revenue to states

2. Transfer of income from Electronic Money Transfer levy exclusively to states as part of stamp duties

3. Repeal of the obsolete stamp duties law and re-enactment of a simplified law to enhance the revenue for states

4. States to be entitled to the tax of Limited Liability Partnerships

5. Tax exemption for state government bonds to be at par with federal government bonds

6. More equitable model for VAT attribution and distribution

7. Integrated tax administration to provide tax intelligence to states, strengthen capacity development and collaboration, and scope of Tax Appeal Tribunal to cover taxpayer disputes on state taxes

8. Powers for AGF to deduct taxes unremitted by a government or MDA and pay to the beneficiary government

9. Framework to grant autonomy for states internal revenue service and enhanced Joint Revenue Board to promote collaborative fiscal federalism

10. Legal framework for taxation of lottery and gaming, and introduction of withholding tax for the benefit of states

News

Tinubu mourns Abubakar’s passing, the Imam who shielded over 200 Christians in his mosque during communal riot

Tinubu mourns Abubakar’s passing, the Imam who shielded over 200 Christians in his mosque during communal riot

President Bola Tinubu has expressed deep sorrow over the death of Imam Abdullahi Abubakar, Chief Imam of Nghar village, Barkin Ladi Local Government Area of Plateau, who passed away at 92.

This is contained in a statement issued by Presidential Spokesperson, Mr Bayo Onanuga, on Friday in Abuja.

The late cleric gained national and international recognition in 2018 for sheltering more than 200 Christians during communal violence in Plateau.

Tinubu described Abubakar as an extraordinary religious leader whose life exemplified faith, courage and a deep reverence for the sanctity of human life.

“At such a time when tribal and religious tendencies seemed to overwhelm reason, Imam Abubakar stood firmly on the side of peace, benevolence and conscience.

“Mindless of the enormous risk to his own life, the noble cleric chose humanity over division, love as opposed to hatred and embrace rather than rejection,” the President said.

He said the Imam’s actions embodied the true essence of faith and delivered a powerful message beyond sermons.

The President noted that the cleric’s uncommon bravery earned him local and international honours celebrating peaceful coexistence.

“I urge religious and community leaders to imbibe and preach the spirit of tolerance, mutual respect and peaceful togetherness as expounded in the life of Imam Abubakar,” Tinubu said.

He prayed that God grants the late Imam eternal rest and rewards him for his courage and good deeds. (NAN)

News

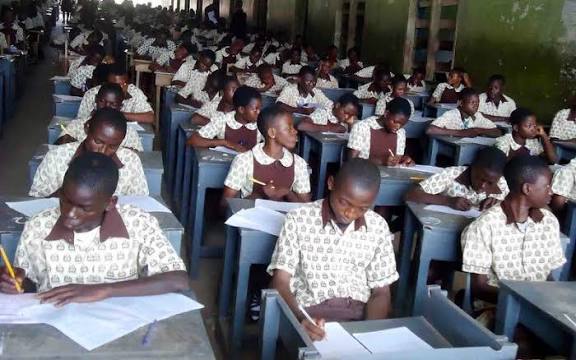

Govt. introduces solar installation, garment making, GSM repairs in jss curriculum

Govt. introduces solar installation, garment making, GSM repairs in jss curriculum

The Anambra Government has introduced 15 entrepreneurial subjects into the Junior Secondary School (JSS) curriculum to enhance students’ practical skills and foster an entrepreneurial mindset.

The News Agency of Nigeria (NAN) reports that the new subjects include solar installation, garment making, GSM repairs, agriculture and processing, plumbing, tiling, POP installation and event management.

Others are bakery, hairstyling, make-up, interior design, CCTV/intercom installation, digital literacy, information technology and robotics.

Prof. Nkechi Ikediugwu, Chairperson ,Post Primary Schools Service Commission (PPSSC), while speaking at the occasion in Awka on Friday, said the initiative was aimed at repositioning education to meet contemporary needs.

Ikediugwu noted that in a rapidly changing world, education should go beyond theory and examinations to equip students with practical skills, creativity, innovation and an entrepreneurial mindset.

“The goal of the programme is to prepare learners, not only to seek jobs but to create value, generate employment and contribute meaningfully to the economic development of the state,”she said.

Mr Cyril Nwuche of Nnamdi Azikiwe University, Awka, delivered a paper titled “Building Entrepreneurial Secondary Schools: Why Every School Needs an Entrepreneurship Club”.

Nwuche said the introduction of entrepreneurial subjects showed that the government was on the path to transforming the state’s economy.

“Traditional academic instruction alone is no longer sufficient to prepare children for the future.

“There is the need for schools to embrace practical and skill-based learning to enable students to thrive in a dynamic global environment, ” he said. (NAN)

News

Two men docked for allegedly defiling underaged girl

Two men docked for allegedly defiling underaged girl

The police in Lagos on Friday, charged two men before an Ikeja Chief Magistrates’ Court for allegedly defiling an 11- year-old girl.

The defendants are: Prince Tomnyie, 40, a businessman, who resides at Agege, and Micheal Adenuga, 24, a furniture maker, who resides at Atere Street in Lekki.

They are standing trial on charges of defilement, and had each pleaded not guilty to the charges.

The prosecutor, ASP Adegoke Ademigbuji told the court that they committed the offence sometimes in December 2024, and September 2025, at Langbasa Ajah and Igbara Lekki, Lagos .

The prosecutor alleged that the victim’s father, had taken his daughter for medical check and it was discovered that the minor had been defiled.

The prosecution alleged that the victim had told her father that his friend, Tomnyie, defiled her sometimes ago.

Ademigbuji alleged that the victim also mentioned the second defendant’s name who lives in their neigbourhood.

The offence contravenes the provisons of section 137 of the Criminal Law of Lagos, 2015.

The Chief Magistrate, Mr L. A Owolabi, granted the defendants bail in the sum of of N600,000 each, with two sureties each in like sum.

He adjourned the case until March 5, for mention. (NAN)

-

6 years ago

Our situation in Kano terrible – Gov Ganduje cries out

-

News11 months ago

News11 months agoFG pledges commitment to enhance Police officers Welfare, implement Tinubu’s 8-point agenda for NPF

-

News11 months ago

News11 months agoBREAKING; NSCDC gets approval to commence 2025 recruitment exercise

-

News9 months ago

News9 months agoAlleged cocaine deal: Court issues orders in suspended DCP Abba Kyari’s case

-

News12 months ago

News12 months agoDPO under investigation for allegedly taking teenage girl to his home while in police custody

-

News12 months ago

News12 months agoJUST IN; Commissioner of Police bows out of Service

-

News9 months ago

News9 months agoJUST IN; Police Inspector dies watching Arsenal match

-

News12 months ago

News12 months agoBREAKING; NLC declare nationwide protest